The context of NFTs

It would seem that in the business world every year must come up with a couple of catchy new concepts that go viral and become touted as the “future of technology.”

Non-fungible tokens or NFTs were one of such concepts.

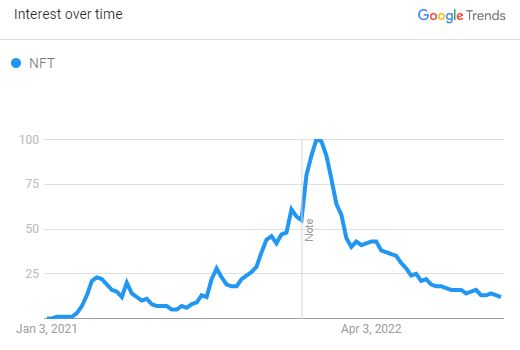

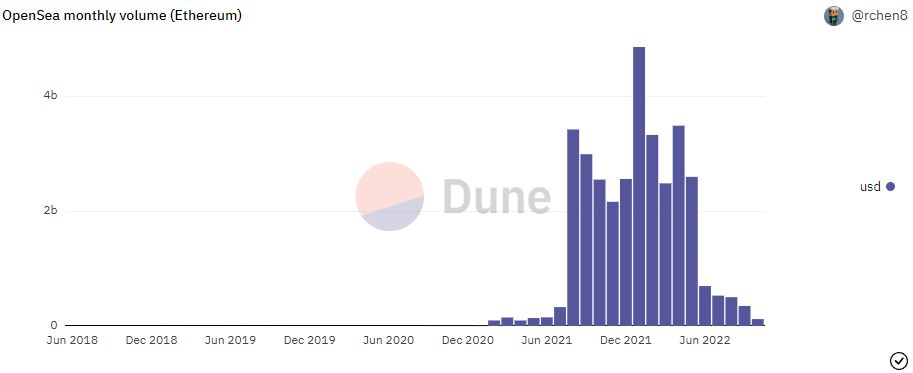

Beginning their spike in interest at the outset of 2021, the world witnessed how the topic of NFTs was first born, then became widespread around half a year later and ultimately died down in June 2022.

During this 1.5 year time frame, NFT minting and trading markets like OpenSea experienced huge growth of their transaction volumes, only to later tank as enthusiasm, as it so often does, quickly waned away.

News outlets like The Observer now report that transactions plunged 97% since January 2022, when the NFT craze was at its hottest.

This surge in growth followed by a bubble burst seems to be a rather common theme in crypto markets and tech in general.

More than a handful of startups, corporations and other would-be industry leaders either borrow dusty and conceptual sci-fi ideas or rebrand already existing ones in order to see if somehow they can sell them to investors or to the wider public. The early adopters themselves often do well, as they exit their positions quickly while the ones left holding the bag are those that were too unaware of what they were really getting themselves into.

In the case of NFTs, the ones that got rug-pulled the most were common day-to-day people that got duped into buying by celebrities, plenty of whom had no intention of supporting their promoted projects for the long term.

Employing fame as a way to promote NFTs might have seemed like a good move at first, but by attaching the technology itself to easily reproducible digital pictures the concept became too shallow too soon. Nowadays, when the topic is brought up it is done so for the sake of mockery.

And still, if one looks past copy-pastable monkey JPGs and jailed rappers Non-fungible tokens may hold much more breadth than what they are initially purported to have.

In gaming, for example, big and small companies have begun working towards integration of the technology inside their products.

Proponents of NFTs believe that this is one of the markets where they will have some value to add.

Is this yet another misguided effort or can NFTs really be useful for videogame consumers?

I personally believe they do not, but let’s explore their alleged use cases so you can draw your own conclusions.

Automated Creator Earnings

Because of the way they can be configured, NFTs have traits which are desirable to creators and, supposedly, publishers. The distinction here is relevant.

As well as determining the number of copies that can be made available, when writing a smart contract into a blockchain creators can set up percentage fees which automatically yield them a share of the proceeds of each exchange transaction performed.

This is one of the most appealing features of NFTs on the supply side, as it ensures that artists are, without any sort of intervention, remunerated multiple times for the work they have done according to its current price valuation.

When it comes to games, effectively what this means is that character cosmetics, skins or basically any marketable asset could be quite profitable for publishers, who would benefit by being able to generate scarcity and a recursive income stream as assets would be passed around in the internal market of their game.

The problem with this sort of logic is that, while the value proposition for the individual creator is there, in an enclosed environment where the game studio itself is responsible for the assets put into the game there is no real reason to establish automated creator fees via NFTs.

Most titles, like Valorant or League of Legends, do not feature an internal market for their skins. Riot hires the artists that design them, holding monopoly over what is sold via their game client.

Players then either purchase the skins available or they do not, and they cannot trade them unless they are willing to sell their entire accounts in secondary markets. The business model is therefore microtransaction based.

Furthermore, NFTs and blockchain technology are not required to create an internal market.

By far the most successful individual game asset market is Valve’s Steam Community Market, where players have been trading gun skins, stickers, gloves, hats and other sorts of digital collectibles for a decade already.

For automated creator earnings to be brought forth as a valid argument for NFT integration in gaming, the assumptions must be made that NFTs will have both an internal market for players to trade as well as offering easy access to it for third-party creators. This is not common, even for massively successful games.

Ultimately, the idea of NFTs being creator friendly would work best in markets like the Unity Store, where game studios purchase engine assets for the games they develop.

For those that do not know what a game engine is, it is a program which gives you the tools for developing a game.

The difference between purchasing an engine asset as a company and an in-game one as a customer, however, remains quite large.

Ownership, governance and interoperability

By having players purchase NFTs they should be able to prove real ownership of the asset outside of the game itself assuming that the token has been recorded in an external blockchain ledger.

Players would also be able to own, either separate from the game asset or included in it, what in crypto lingo is called a “governance token”.

Governance tokens enable their controllers to vote on proposed changes for their assigned smart contract.

Depending on the configuration of the contract this could mean a lot of different things.

Much like it happens with equity and other sorts of ownership contracts, governance tokens could grant their owners voting rights over decisions that shape the overall direction of a game, the assets within a game or even make them eligible for revenues the same way dividends are periodically distributed to traditional shareholders.

But the features of NFTs when it comes to gaming do not end there, for their supporters claim that they could shift the industry standard towards asset interoperability.

Interoperable assets are those that the owner can transfer across different games which are established under the framework of the same parent blockchain.

Players would then be able to, for example, make use of the same object in two or more titles within the same ecosystem, which also means that said object could be sold to others so they could use it for their preferred game of choice.

The concept of interoperability is important for gaming NFTs. Should it become a reality it would mean that the owner of an NFT holds one item whose value is not dependent on the success of a single game.

Publishing companies know it well, support past a title’s growth phase lasts for as long as it remains profitable. Businesses eventually pull the plug on legacy and no longer patch nor spend on server upkeep when operative expenses exceed revenue. NFTs would be a way for player assets to survive past this natural phase in the life cycle of any videogame.

Can all of the aforementioned sound appealing? Yes, to some.

Is it really feasible? It most likely is not.

The reason why it is doubtful that in practice NFTs will be interoperable and transferable across games is due to the sheer amount of coordination and compatibility requirements that such a thing would entail.

We must consider the context the products of the industry find themselves in.

Compare mobile games with PC games, or different types of games across the same platform and games of the same genre developed by different studios.

Videogames are highly technical and artistic creations which must be specifically tailored for both the franchise, the genre and the system they are intended for.

For these purposes, multiple marketed and in-house engines have to be deployed, each carrying their own set of quirks and expiry date.

And even across games that share the same engine type, the way assets fit into the world of the game itself can be quite different, being highly customized for the end product.

Under industry conditions where titles are seldom homogeneous, generating an environment for interoperable NFTs would require an unprecedented level of standardization, hence why support for the same NFT across multiple games becomes extremely unlikely.

How are interoperable assets meant to be transferred and used across an industry ripe with games, genres, engines of a different ilk? Let alone one where different publishers are unlikely to agree on using the same blockchain protocol?

Would these NFTs be purely cosmetic or would they grant players similar in-game statistics? Would I be able to use my sword of unspeakable doom in my gardening simulator? My 3D-modeled racing car in my 2D platformer?

The point of making these questions is to illustrate that, for assets to be transferable, what would need to happen is each publisher adhered to the parent blockchain working on their compatibility for their own game. That is, they would have to design the aesthetic look and other relevant variables that the NFT asset attached to that particular title would have inside of it.

Why bother doing so when the studio can just design and sell assets as microtransactions?

It is for these reasons that the concept of interoperability seems like a logistical nightmare with unclear returns on investment.

Dispossessed of transferability, much of the allure of ownership and governance evaporates as well when considering that the NFT is now only able to work in only one game, the one it is designed for.

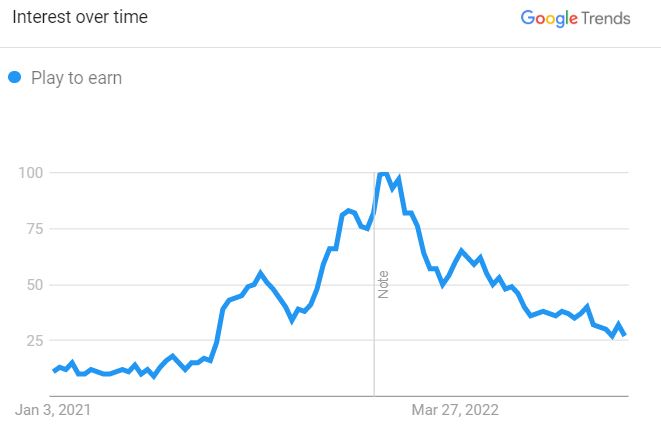

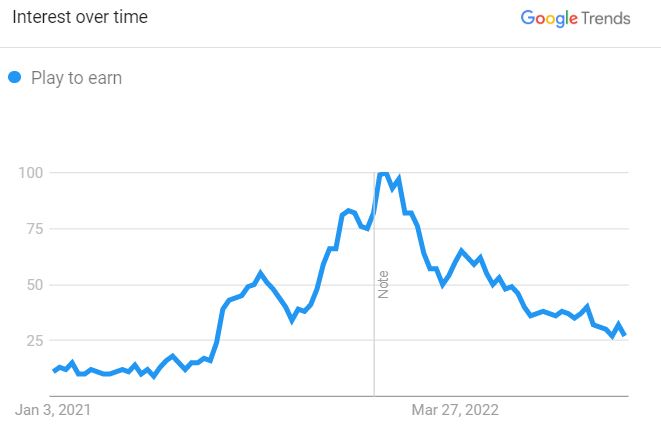

Play-to-earn business models

Yet another feature of NFTs inevitably tied to crypto tokens and their respective blockchains are “play-to-earn” business models.

The term is self explanatory; it allows players to receive coin tokens when playing. The way the business model works is by having a game company or an umbrella of game companies set up a blockchain and one or more cryptocurrency coins which players are rewarded with when fulfilling in-game tasks.

The main sought-out incentive that follows implementation of these models, therefore, is users being able to make money while playing. The company exacts a commission from transactions or gets revenue via token generation and trading.

Thus far the most famous play-to-earn title has been Vietnamese Sky Mavis’s Axie Infinity. Released in 2018, Axie revolves around digital creatures that fight enemies as well as each other. Players can upgrade these pets and gather resources for later trading.

There are stories of people in developing and third-world countries like Venezuela making use of Axie Infinity as a way to secure a living wage. Approaching it like a full-time job, these people would spend their whole days playing Axie, exchanging pet NFTs and the game’s two tokens for other cryptocurrencies and standard fiat. Players from these countries would even form professional multilayered guilds that would rent out necessary in-game resources to new players so they could start earning.

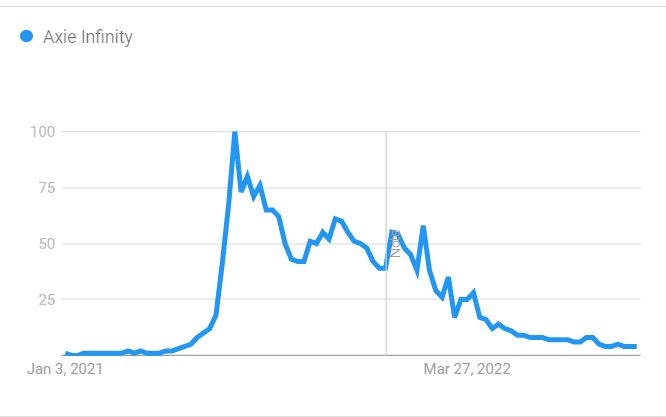

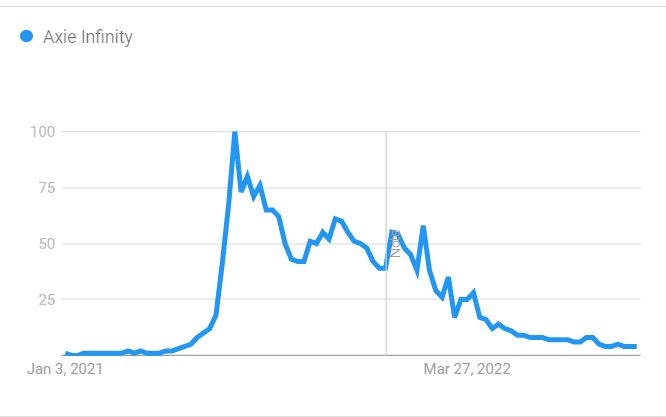

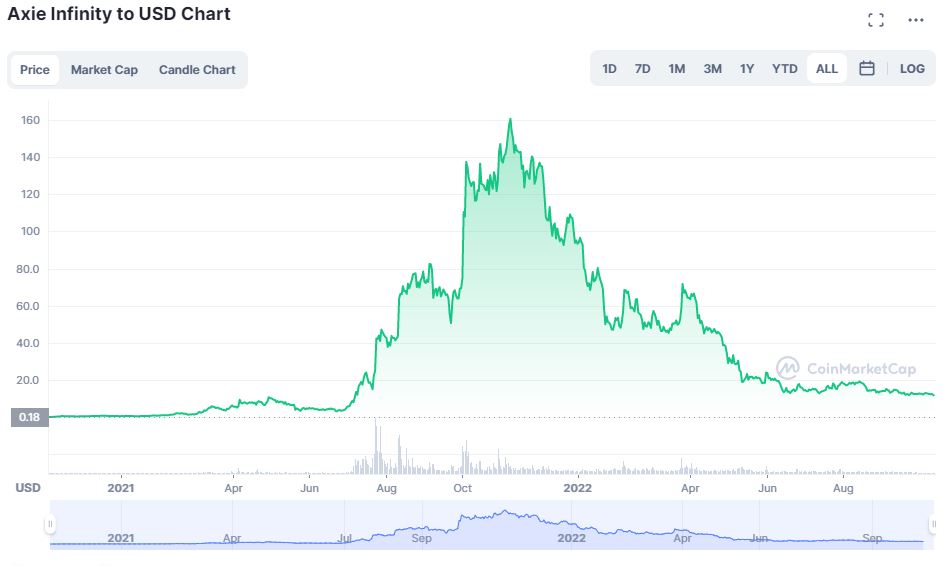

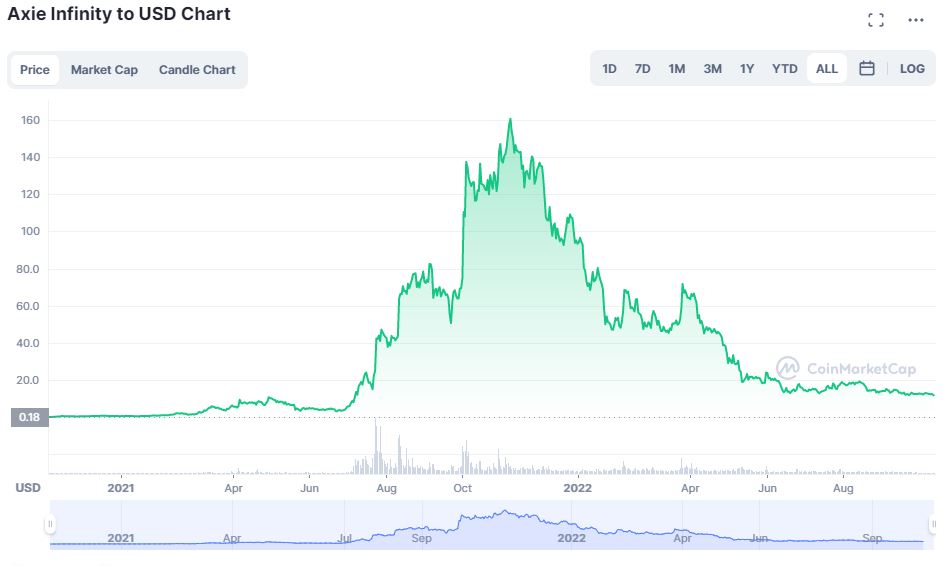

Search volume for Axie Infinity picked up pace around June 2021, while in October its designated governance token AXS would rise to an all-time high of 160$ in price from half a dollar per unit at the beginning of the year; Axie’s other token, SLP, would also experience high volatility.

Unfortunately, dilution of coin supply combined with an overall loss of interest in both the game and crypto markets would end up rendering the price of both AXS and SLP tokens much lower than their short-lived all-time highs.

Further confidence in Axie was lost following a 600 million dollar hack of its blockchain network, one of the biggest cybercrimes in crypto history.

As the most famous experiment to date, Axie Infinity has not established a promising precedent for others to follow. Perhaps due to the originality of the play-to-earn concept it had its moment of fame, but nothing more.

There are, in my view, four main concerns that hinder the potential of play-to-earn and their derived NFTs:

- Aside from short-term time frames, the value of the tokens is intrinsically attached to the popularity of the games the tokens work with. Thus, if we exclude pyramid speculation stemming from FOMO and Greater Fool Theory we find ourselves with tokens that are unlikely to remain high-priced for a long time unless given support by big publishers.

- Though some may welcome the idea of bringing some sort of financialization to games, it is probable that a majority of players would not be fine with it. The same as with microtransaction models, instances of backlash for play-to-earn and blockchain games already exist. Quantifying before the fact how representative of the whole population is this backlash is hard, which poses a problem for big publishers to jump into them. And unlike microtransactions, it is unclear if play-to-earn can be sustained by a minority of buyers.

- Should big publishers decide to jump into the idea, creation of blockchain tokens that supports their games would be an open invitation for institutional regulation from multiple sides.

See, for example, how Facebook (now Meta Platforms) had to back down on its plans for Libra, a project which is now surrounded by uncertainty; or how the European Union is moving forwards crypto regulation which includes separation of coin offerings types, supervision of decentralized finance (DeFi) and energy expenditure disclosure. The question of taxating the income of players or money laundering concerns would also stand out for regulators.

- Lastly, blockchain security, game security, age issues and the general impracticability of the crypto space are relevant factors to take into account.

Nevertheless, unlike with the interoperability of NFT in-game assets, I consider play-to-earn to not be as susceptible to compatibility issues.

With this scenario, the technical aspects of implementation are not the main problem; it is the notion that you would be using a tradeable ActivisionBlizzard token, a Riot coin and so and so forth that seems rather unlikely.

These are some of the few subsidiaries in the space that can support a wide enough range of games for a hypothetical blockchain. I question whether they are really interested in bringing their in-game economies outside their shell by involving themselves with the idea of play-to-earn.

They can just sell microtransactions and standard retail titles.

Conclusion

While not outside the realm of possibility, when it comes to gaming NFTs and the technology they come paired with do not offer enough positives to call for implementation on a large scale.

From the developer angle interoperability across games requires too much work and coordination.

From the publisher angle it requires creation of in-game asset markets accessible to third-party creators on top of having to connect them to a blockchain. The former can be done without the latter.

Companies can decide to just stick to microtransactions, not risking the ire of antitrust and the like.

From the customer side there are those who outright reject crypto, NFTs and blockchain in video games. They argue that they simply want to play and have fun, not be drawn into what they perceive is complex gambling and speculation.

It would take a long time and effort to shift the culture in favor of these hard to grasp technologies, which could possibly happen if a strong enough game ecosystem came to fruition. Doing so would imply putting more emphasis on creating an enjoyable and sustainable user experience rather than adding accessory monetization models. Not impossible, but improbable.

Overall, I consider that NFTs in gaming constitute a headache for suppliers.and an over-engineered solution of little intrinsic value to consumers.

Also available in: